GST is charged at standard rate of 0 on the part of work performed until 31 August 2018. Imposition of Sales Tax.

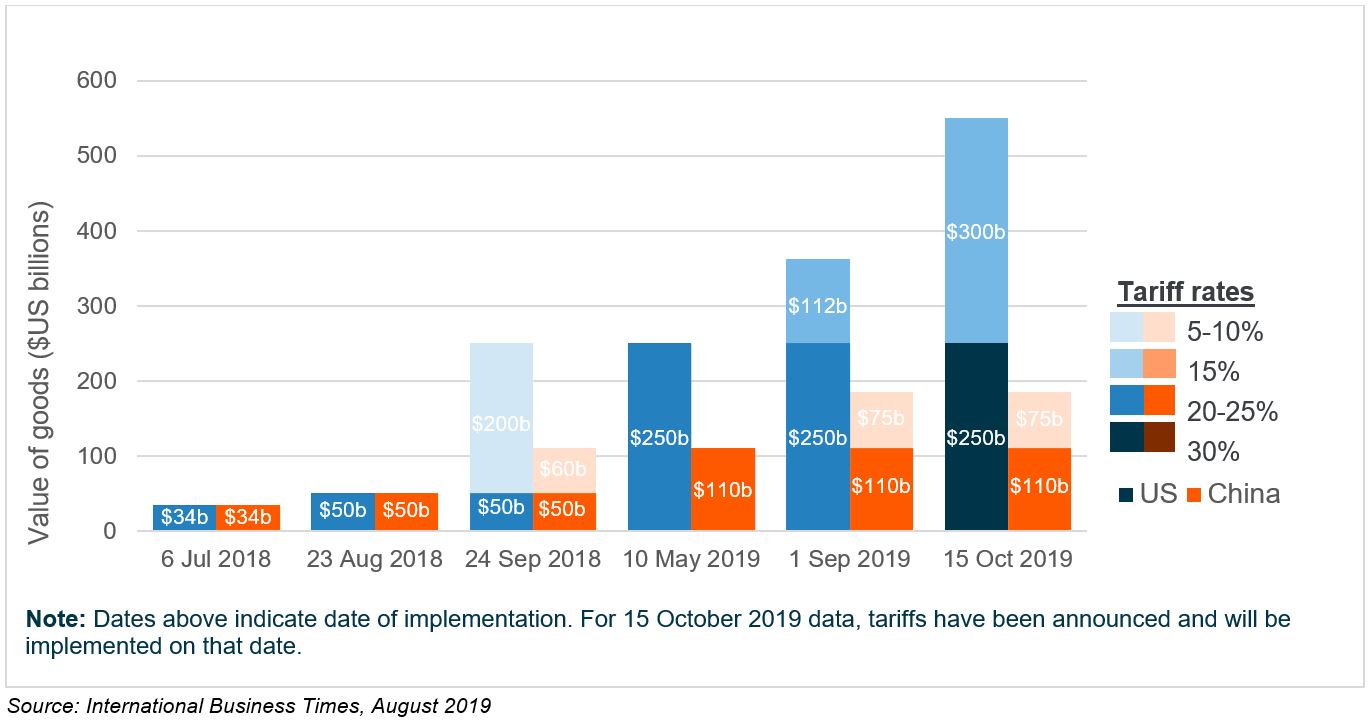

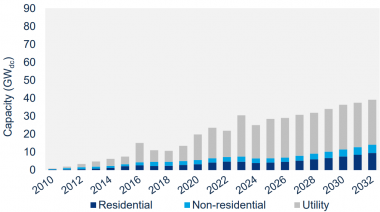

The Us China Trade Wars And The Solar Industry Us Solar Fund Uk

Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018.

. Meanwhile the balance of the work completed on 15 October 2018 shall be charged with Sales Tax at 10. On the First 5000 Next 15000. Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas.

Please refer to Sales Tax Goods Exempted From Tax Order 2018 and. You need to be aware of the following. Live animals-primates including ape monkey lemur galago potto and others.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment. Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the.

First Name Last Name. Last published date. Calculations RM Rate TaxRM 0 - 5000.

Rates of tax 1. Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia. Shipping Rates Based On.

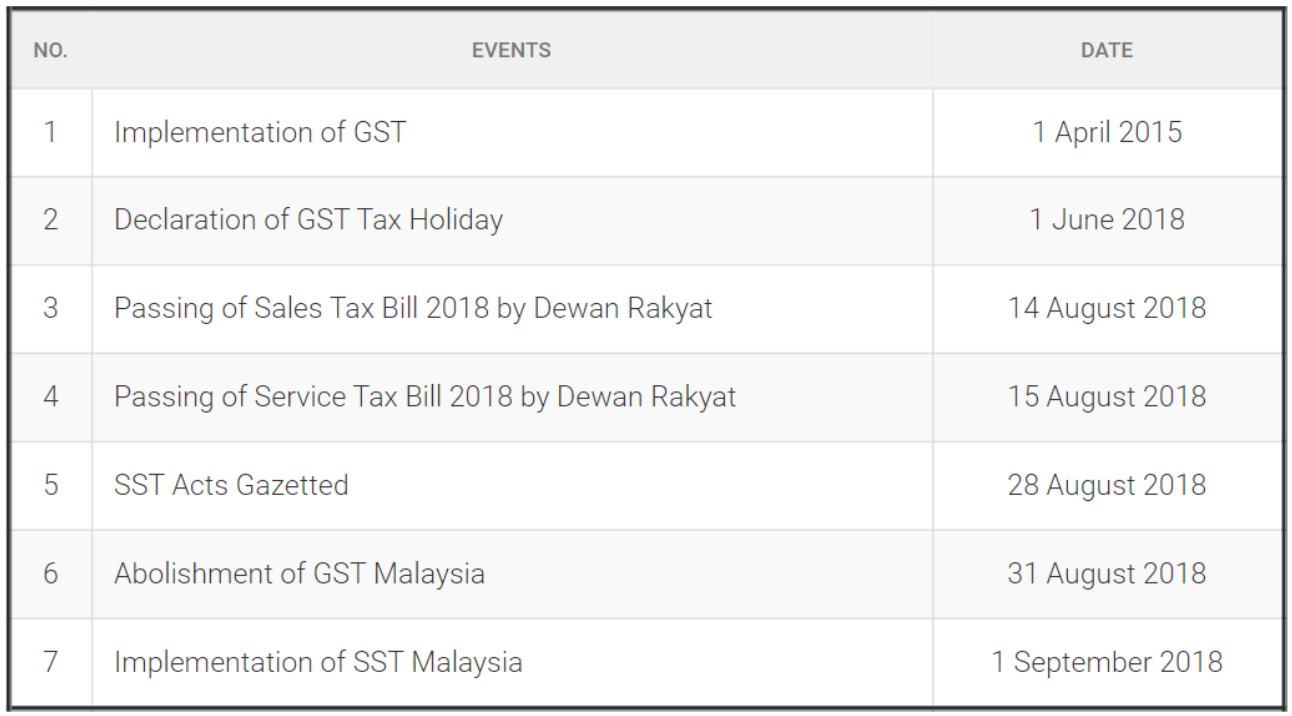

The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods. Sales Tax Rates of Tax Order 2018. The Goods and Services Tax Rate of Tax Amendment Order 2018 Order was gazetted on 16 May 2018 and takes effect from 1 June 2018.

Corporate Income Tax. Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018. These new rates will apply for those who have accumulated their income from January 2018 to December 2018 and are filing their taxes from March April 2019.

Assessment Year 2018-2019 Chargeable Income. Corporate tax rates for companies resident in Malaysia is 24. Every country is.

All non-residents are taxed at a flat rate of 28 percent. Under the Order all taxable supplies of goods and services which are made in Malaysia and all importation of goods into Malaysia would be zero-rated. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods.

What is the tax treatment on the subcontract work. Subject to an importexport license from the relevant authorities This Guide merely serves as information. Income tax is managed by the Inland Revenue Board of Malaysia which determines how much tax is paid on ones income.

More information on import declaration procedures and import restrictions can. Trying to get tariff data. What is the name of your Insurance Broker.

Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. Reduction of import duty rate on bicycles. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

This page provides - Malaysia Import Prices - actual values historical data forecast chart statistics. Import Prices in Malaysia increased to 129 points in April from 12590 points in March of 2022. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities.

These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. On the First 5000. SST is administered by the Royal Malaysian Customs Department RMCD.

Import Prices in Malaysia averaged 10873 points from 2008 until 2022 reaching an all time high of 129 points in April of 2022 and a record low of 8530 points in January of 2008. What is the treatment for importation of Big Ticket Items for upstream petroleum. Goods are taxable unless they are specifically listed on the sales tax exemption list.

Your shipment may be subject to a custom duty and import tax. The new Sales tax will be levied on taxable goods that are imported into or manufactured in Malaysia. GST was only introduced in April 2015.

25 May 2018. Services to Malaysia consumers will be required to register for service tax with Malaysia Customs and charge service tax. On 2 November 2018 the Malaysia Minister of Finance tabled the 2019 National Budget.

Import duties are levied on goods that are subject to import duties and imported into the. For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

Source 1 Source 2 22 Dec 2017 What is. Required to calculate Import Duties Taxes. Currently the importation of bicycles other than racing bicycles and bicycles designed to.

Page 2 of 130. The proposed sales tax will be 5 and 10 or a specific rate for petroleum. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods.

According to the recent RMCD Guidance a general exemption under the proposed. Rate TaxRM A. Check out our free calculator to get an instant estimate.

General Guide On Sales Tax - Ver 4 As at 19 January 2019. On the First 5000. Egg in the shells.

For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates. Up to 2 cash back Want visibility on duties and taxes when shipping from Malaysia to Malaysia. Start Shipping To Malaysia With Confidence.

More information on import declaration procedures and import restrictions can. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. NAME OF GOODS HEADING CHAPTER EXEMPTED 5 10.

For residents tax is paid on a sliding scale - so the more you earn the more tax you pay - but theres a cap of 28 percent. To calculate the approximate costs of road tax.

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Service Tax Exemption On Eligible Labuan Incorporated Entities

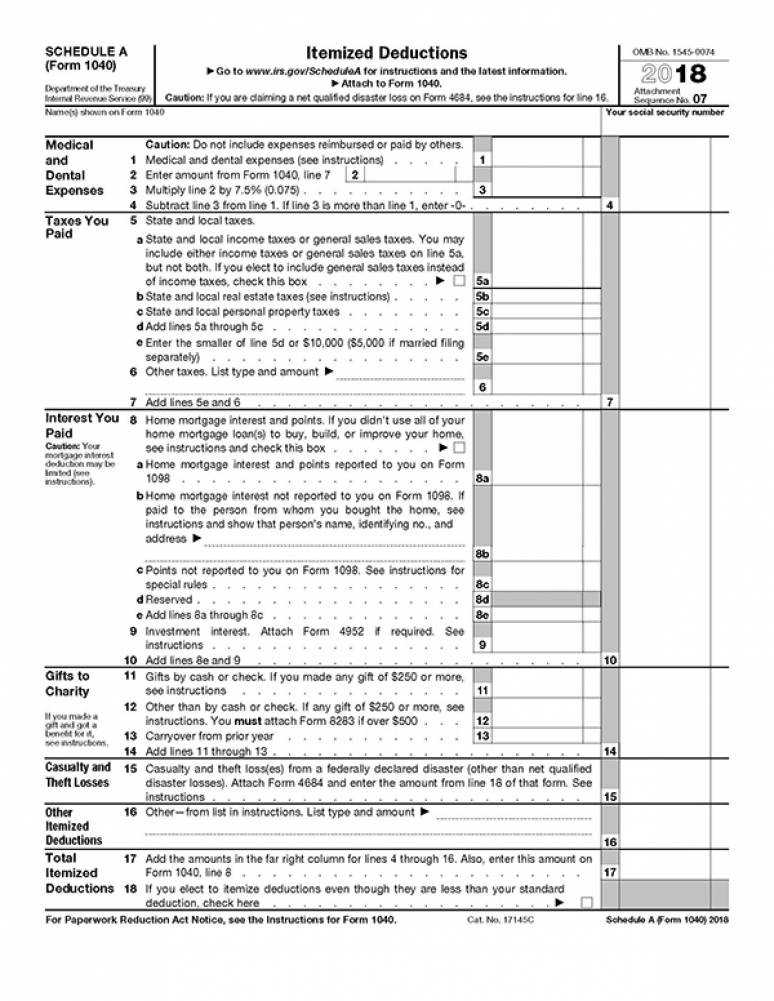

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Tonga Sales Tax Rate 2022 Data 2023 Forecast 2014 2021 Historical Chart News

U S Solar Tariffs Bolster Growing Dominance Of Bifacial Panels Reuters Events Renewables

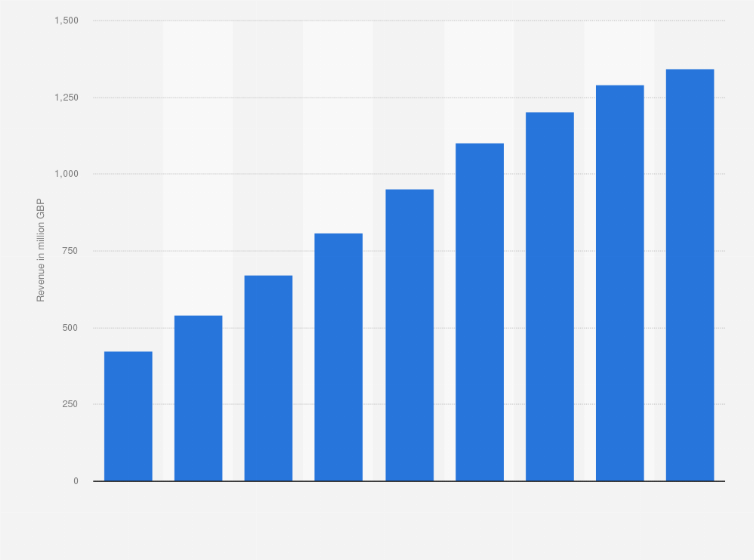

Costa Coffee Revenue 2010 2018 Statista

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary

Update On Anti Dumping For Some Monosodium Glutamate Msg Food Additives Food To Make Asian Cuisine

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

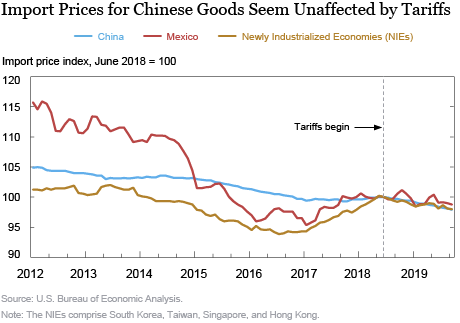

Who Pays The Tax On Imports From China Liberty Street Economics

Where Tariffs Are Highest And Lowest Around The World Infographic

U S Solar Tariffs Bolster Growing Dominance Of Bifacial Panels Reuters Events Renewables

Malaysia Imports From China 2022 Data 2023 Forecast 2015 2021 Historical

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary